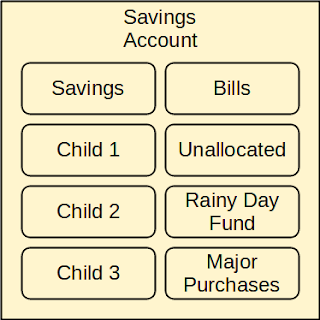

In order to make the Payment from Savings Banking Model work smoothly, there needs to be some amount of isolation of money within the savings account. Imagine, for example, if all of the savings money was lumped into one big heap within the same savings account. It would become very difficult to know:

- How much money has already been allocated to pay pending bills

- How much money has been saved for rainy days, major purchases or general savings

- How much money has been set aside for each child's future

- How much money is still available to use for "whatever" because it has not yet been allocated for some other use

Separate Savings Accounts

One solution would be to isolated money into different savings account. That solution would work, but does not seem practical. Managing a large number of accounts would be cumbersome for several reasons. For starters, the savings accounts would likely be spread across multiple banks, and it could take several days to move money between accounts should that become necessary.

Separate Virtual Accounts within One Savings Account

A better solution is to have one savings account that allows money to be isolated into separate savings buckets, while continuing to earn HYSA rates for all savings buckets, and allowing easy transfer between savings buckets, and perhaps even easy transfer back and forth between savings buckets and a paired checking account.

Luckily, some of the banks have started providing technology for using isolation buckets. The banks typically refer to these as savings vaults, savings goals, virtual accounts (not be confused with virtual credit card numbers), etc.. The banks that provided these features tend to be the "mobile first" oriented banks that work on ease of use from mobile apps before they put the same features into a more traditional web sites.

SoFi HYSA is an Ideal Choice

The SoFi High Yield Savings Account does well at providing all of the desired features. SoFi calls the isolation buckets "Vaults". The only difference between the SoFi HYSA and the diagram above is that the bills should probably not be isolated into a vault, but should instead just be the money in the savings account that is not placed into a specific vault, as is indicated by the dotted line below.

With all things being equal, it would make sense to have the unallocated money unvaulted (just floating in the savings account, not isolated into a vault), and put the money for pending bills into a vault. But, all things are not equal. Bank ACH transfers to and from the SoFi HYSA will go to and from the unvaulted money. It is not possible to do bank ACH transfer directly into or out from a vault. Therefore, since the Payment from Savings Banking Model relies on being able to pay bills directly from the savings account, it makes sense to keep the money for pending bills inside the savings account but outside of a specific vault.

It should be noted that leaving the bill money unvaulted and making the unallocated money vaulted is not a hinderance, but rather just a practical usage pattern. The SoFi app and website let you transfer money between checking account, unvaulted savings account, and savings vaults for free, without count or dollar limits, and within seconds.

Revised Payment from Savings Banking Model

Given the discussion above, the diagram of the Payment from Savings Banking Model is now changed as is shown below.

My next article will go back to the top of that diagram and discuss why the paired checking account still has an essential role in the Payment from Savings Banking Model.

No comments:

Post a Comment